CycleMoneyCo Cash Around is a term that often surfaces in conversations about alternative finance, short-term liquidity, and modern cash access models. For many people, it represents convenience and speed, while for others it raises questions about cost, transparency, and long-term impact.

This guide is designed to be a definitive, plain-spoken resource that explains how the concept works, where it fits in today’s financial landscape, and how to evaluate it responsibly. The goal is clarity, not promotion, so readers can make informed choices with confidence.

Understanding the Core Concept

At its foundation, CycleMoneyCo Cash Around refers to a system built to provide quick access to funds without the friction of traditional lending processes. It positions itself as flexible and user-centric, aiming to reduce waiting times and paperwork.

This model appeals to users who value speed and accessibility, especially in situations where conventional banks feel slow or restrictive. Understanding this baseline is essential before evaluating deeper mechanics or trade-offs.

Why Cash Access Models Are Evolving

cyclemoneyco cash around Financial behavior has shifted significantly over the last decade as people expect services to mirror the speed of digital commerce. Cash access products evolved to meet on-demand lifestyles shaped by gig work and irregular income patterns.

These trends created space for platforms like CycleMoneyCo to experiment with faster approvals and simplified eligibility. The evolution is less about replacing banks and more about filling gaps they traditionally leave open.

How the Platform Positions Itself

CycleMoneyCo frames its offering around ease, control, and predictability. Marketing language often emphasizes transparency and user empowerment, suggesting a departure from opaque fee structures.

Positioning matters because it shapes user expectations. When a service claims simplicity, any friction or hidden cost becomes more noticeable and potentially damaging to trust.

The Role of Short-Term Liquidity

Short-term liquidity solutions exist to solve immediate cash flow issues rather than long-term financing needs. They are tools, not strategies, designed for temporary use.

When used appropriately, these tools can bridge timing gaps between expenses and income. Misuse, however, can turn convenience into dependency, a theme that deserves careful attention.

Eligibility and Access Considerations

Most cash access platforms reduce barriers by minimizing credit checks or emphasizing alternative data. This approach broadens access for users who might be underserved by traditional lenders.

While accessibility is positive, it also places responsibility on users to self-assess affordability. Easy entry should never replace thoughtful financial judgment.

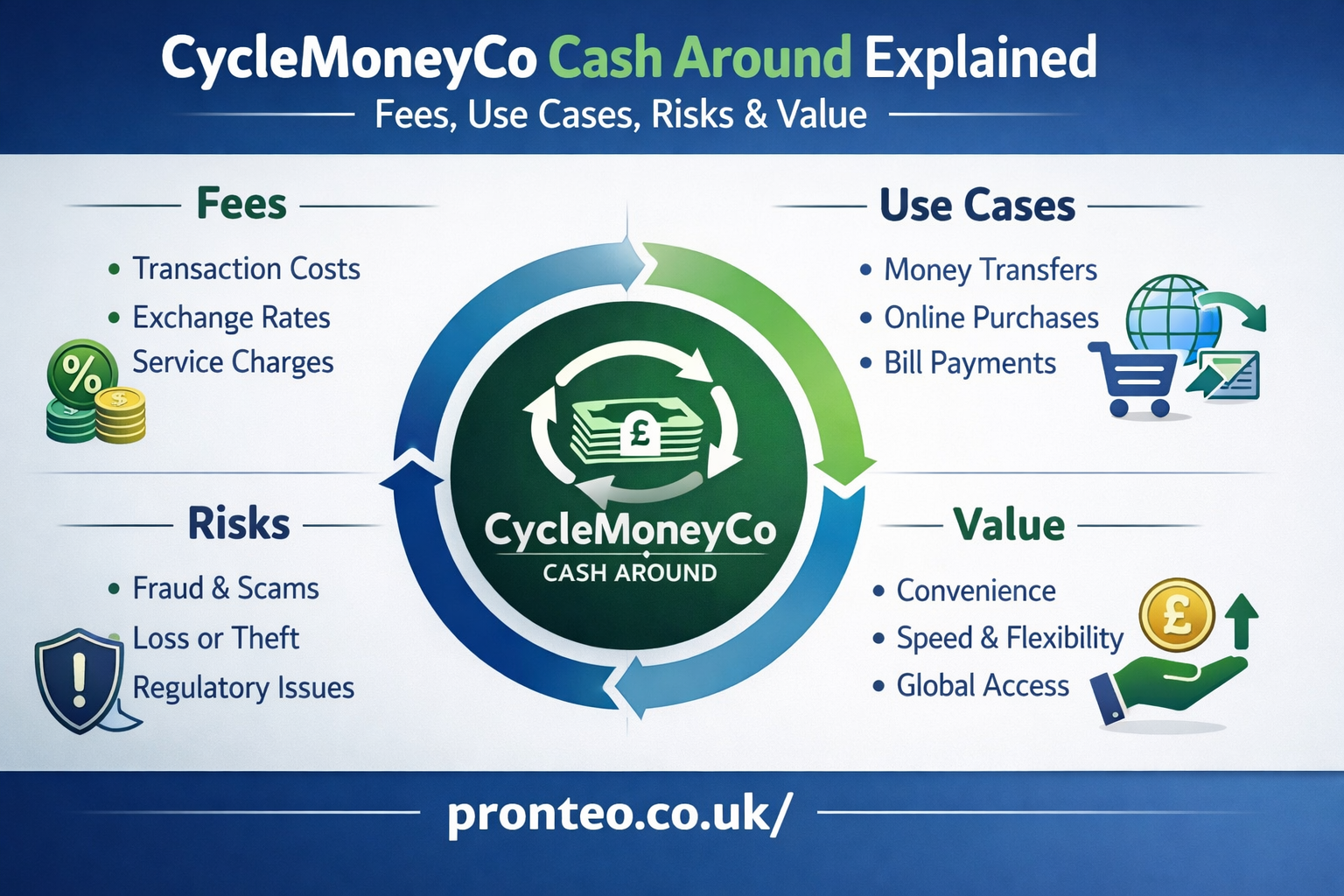

Fees, Costs, and Pricing Signals

Cost structures are where many misunderstandings arise. Fees may appear modest individually but compound quickly when usage becomes frequent.

A clear-eyed view of pricing helps users compare real costs rather than advertised benefits. Transparency is not just about disclosure but about making implications easy to understand.

A Practical Cost Comparison Table

The table below outlines common cost elements users typically encounter when evaluating cash access services.

| Cost Element | Typical Range | What It Means for Users |

| Access Fee | Low to Moderate | Paid for each cash request |

| Processing Time Premium | Optional | Faster access costs more |

| Late Repayment Penalty | Variable | Applies if terms are missed |

| Subscription Component | Monthly | Ongoing access privilege |

Understanding these components helps users contextualize overall value instead of focusing on a single headline fee.

Transparency Versus Complexity

Transparency is often promised, but complexity can still exist beneath simple language. Terms and conditions may include scenarios that only matter under stress.

Reading beyond summaries is essential. The most informed users treat simplicity claims as an invitation to verify, not an assurance to relax scrutiny.

Risk Awareness and Responsible Use

Every financial tool carries risk, particularly those designed for speed. The primary risk is overreliance, where short-term solutions become habitual.

Responsible use means defining boundaries in advance. Knowing when and why you would use such a service prevents reactive decisions driven by urgency alone.

Behavioral Finance Perspective

From a behavioral standpoint, instant access can encourage impulsive choices. The psychological relief of quick cash may overshadow rational cost assessment.

Awareness of this bias helps users pause and evaluate alternatives. Financial literacy is as much about mindset as it is about numbers.

Comparing Traditional Banks and New Models

Banks prioritize stability and regulatory compliance, which often slows processes. Cash access platforms prioritize speed, sometimes at the expense of depth.

Neither model is inherently superior. The optimal choice depends on context, urgency, and the user’s broader financial picture.

Use Cases That Make Sense

There are scenarios where fast access is genuinely useful, such as covering a short gap before a confirmed payment. In these cases, cost may be justified by avoided penalties or disruptions.

Clarity about use cases prevents misuse. Tools designed for exceptions should remain exceptions, not defaults.

Common Misconceptions Explained

One misconception is that speed always equals high cost. In reality, costs vary widely depending on usage patterns and repayment behavior.

Another misconception is that accessibility implies leniency. Terms are still binding, and missed obligations can have consequences similar to traditional credit products.

Regulatory and Compliance Context

Regulatory frameworks for cash access services differ by region and continue to evolve. Oversight aims to balance innovation with consumer protection.

Staying informed about regulatory status adds another layer of due diligence. Compliance signals maturity and long-term viability.

Data Security and Privacy

Financial platforms handle sensitive personal and transactional data. Strong security practices are not optional but foundational.

Users should look for clear privacy policies and evidence of encryption standards. Trust is built through both words and technical safeguards.

User Experience and Interface Design

Ease of use often differentiates platforms more than pricing. Clear dashboards, straightforward requests, and timely notifications enhance confidence.

A good interface reduces cognitive load. When users can see obligations clearly, they are more likely to manage them responsibly.

Long-Term Financial Impact

Repeated use of short-term cash tools can subtly reshape financial habits. What begins as occasional support can influence budgeting norms.

Evaluating long-term impact requires stepping back from individual transactions. Patterns matter more than isolated decisions.

Alternatives Worth Considering

Alternatives include emergency savings, employer-based advances, or flexible budgeting tools. Each has its own trade-offs.

Comparing options ensures that convenience does not crowd out sustainability. The best solution often combines multiple approaches.

Expert Insight on Cash Access Trends

As one financial analyst notes, “Speed in finance is powerful, but power without discipline can quietly erode stability.” This perspective underscores the importance of intentional use.

Trends suggest continued growth in flexible cash models. The challenge lies in integrating them into healthy financial ecosystems.

Evaluating Value Beyond Speed

True value includes predictability, fairness, and alignment with personal goals. Speed alone is an incomplete metric.

Users benefit from framing decisions around outcomes rather than urgency. This shift transforms tools into allies rather than crutches.

Decision Framework for Users

A simple framework involves assessing urgency, cost, alternatives, and repayment certainty. Skipping any step increases risk.

Structured thinking counterbalances emotional pressure. It turns reactive choices into deliberate actions.

The Role of Financial Education

Education empowers users to navigate modern finance confidently. Understanding mechanisms reduces fear and overconfidence alike.

Platforms that support education contribute positively to user outcomes. Knowledge and access should grow together.

When CycleMoneyCo Cash Around Fits Best

CycleMoneyCo Cash Around fits best when used sparingly, intentionally, and with full awareness of costs. It is most effective as a bridge, not a foundation.

Contextual use preserves its benefits while minimizing downsides. The tool works best when it serves a clear, limited purpose.

Conclusion

CycleMoneyCo Cash Around represents a broader shift toward flexible, user-driven financial solutions. Its value lies in convenience, but its risks lie in overuse and misunderstanding.

Approached thoughtfully, it can be part of a balanced financial toolkit. The key is informed choice, grounded expectations, and disciplined use.

Frequently Asked Questions

What is cyclemoneyco cash around used for?

CycleMoneyCo Cash Around is typically used for short-term cash needs where speed matters more than long-term financing considerations.

Is cyclemoneyco cash around expensive compared to banks?

Costs can be higher than traditional bank options, but cyclemoneyco cash around may offer value when avoiding late fees or urgent disruptions.

Can cyclemoneyco cash around affect financial habits?

Yes, repeated use of cyclemoneyco cash around can influence spending and budgeting behavior if not managed carefully.

Is cyclemoneyco cash around regulated?

Regulation depends on jurisdiction, and users should verify local compliance before relying on cyclemoneyco cash around services.

When should someone avoid cyclemoneyco cash around?

It should be avoided for ongoing expenses or when repayment is uncertain, as cyclemoneyco cash around is designed for temporary gaps, not chronic needs.

Leave a Reply